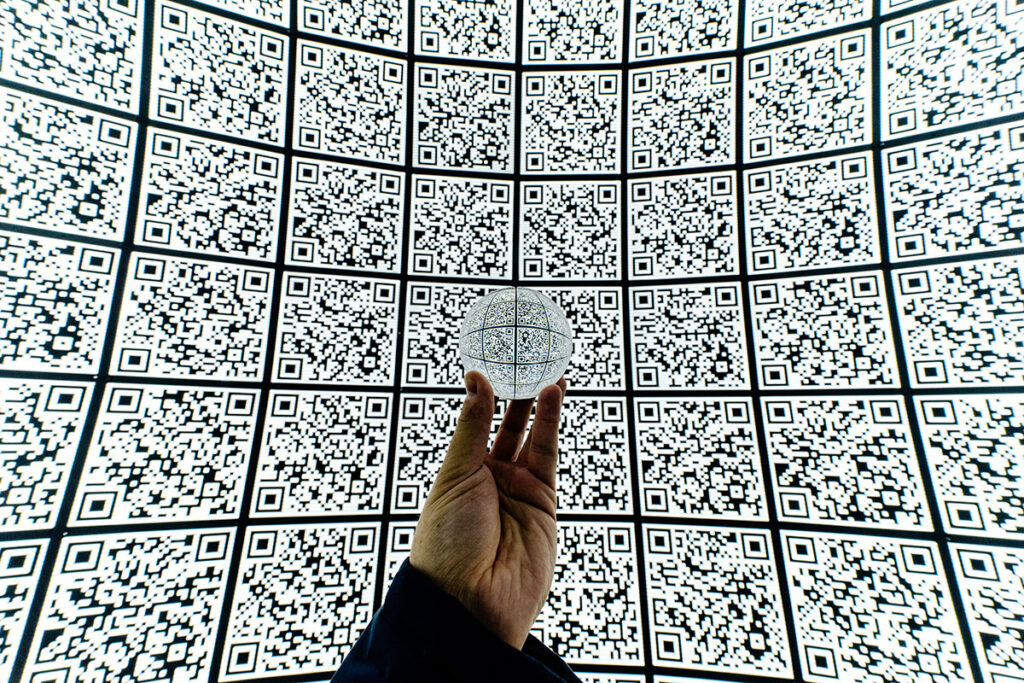

It’s fair to say that QR codes have had a slow burn in Australia, especially when it comes to payments. However, all this could be about to change.

It’s been 26 years since the humble QR Code was created by a Toyota subsidiary to better manage supply chain inventory. As with most technology-related inventions, timing is everything and as mobile phone usage exploded across Asia, innovative companies saw the QR Code as a way to refer users to websites without requiring them to type a URL in English. Due partly to the lack of existing POS infrastructure and perhaps a reluctance to adopt terminals due to their added cost, AliPay and WeChat Pay made QR Codes a fundamental part of their payment processes and its future in Asia was assured.

Here in Australia, it’s a very different story. Why didn’t QR Codes take off in the same way? Well, there’s a couple of good reasons:

- POS terminals have been pervasive in Australia since the eighties and we now have among the highest penetrations in the world with around 1 million terminals across the country – that’s one for every 12 adults. Of course, this has favoured the banks and card schemes who happily take a cut of every transaction.

- Initially most smartphones needed an app to scan a QR Code, which created a significant barrier to their adoption. However, when Apple released iOS11 in 2017, QR codes could be scanned directly from the phone’s camera, and considering the iPhone’s 52% market share at the time, a QR Code scanner was now just a swipe away for most people. QR Codes are now everywhere in Australia, and they’re no longer limited to sending people to product websites. McDonald’s uses QR codes to claim discounts in the MyMaccas App. Retail stores like Zara and H&M use them as part of their returns process. And in the payments world, AliPay and WeChat Pay have now been joined by PayPal who recently announced QR Code support targeted at small merchants.

As part of Azupay’s real-time payment process, a custom QR Code is generated at the online checkout to move the PayID (and all transaction information) to the consumers mobile device, where the payment can be made. This avoids the consumer having to re-type the PayID and streamlines the checkout process.

Guardians of Australia’s New Payments Platform, the NPPA has released a QR Code specification that can be freely adopted by any bank looking to more tightly integrate their NPP payments processes. So far though, the banks have been slow to do this.

So what does this mean for the future of the POS terminal? Can the humble, low-tech QR Code really replace millions of dollars of well entrenched payment infrastructure in Australia? Possibly, but probably not anytime soon. Before this happens, we’ll see QR Codes integrated with existing POS devices – AliPay, WeChat Pay and now PayPal have all done this – and it’s only a matter of time before others follow. It’s then up to the banks and payment providers to demonstrate the relevance and added-value that traditional POS terminals deliver to merchants and consumers.

Whatever happens, the QR Code’s future in Australia now looks more and more assured, despite us being a little late to the party.