Australia’s first New Payments Platform-powered real-time receivables solution for businesses.

Enabling real-time, low cost payments for you and your customers

Azupay’s implementation options meet a broad range of business needs.

Why wait days for your business to get paid?

With Azupay, you receive funds in real-time directly from your customers bank account.

Receive funds in real-time

1:47 duration

Admin

Payments can be error prone and inefficient. Reconciliation processes are costly and time consuming.

Time

Settlement times are too long. Your business can’t receive payment on weekends or public holidays.

Fraud

The value of card-not-present crime rose 7.8% to $478 million in 2019 and accounts for 85% of all credit card fraud. Globally, merchants lose around 7.5% of revenue to chargebacks.

Cost

Credit card fees take a percentage of your revenue and interchange fees still remain, increasing the overall cost to your business. In 2018, Australian credit card fees totaled $1.5 billion.

The problem with payments today

The problem with payments today is that they can often be slow, expensive, and insecure. Traditional payment methods like bank transfers and credit card transactions can take days to process and can come with high fees, while cash payments can be risky and inconvenient.

Azupay makes payments faster, safer and smarter for you & your customers

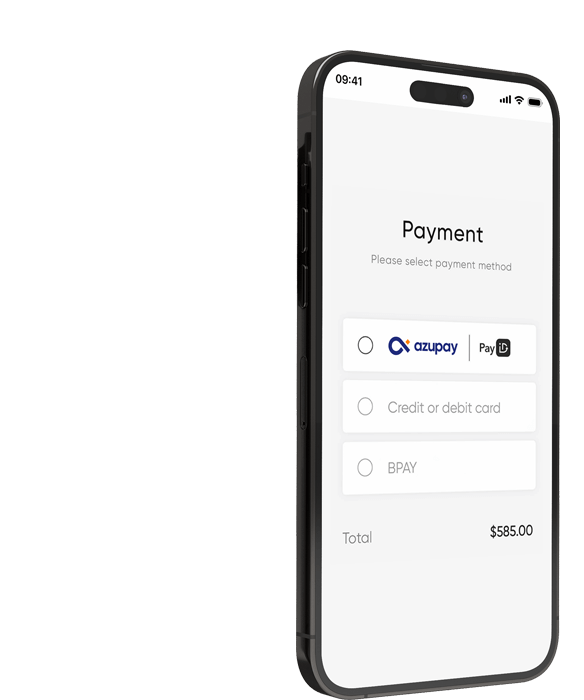

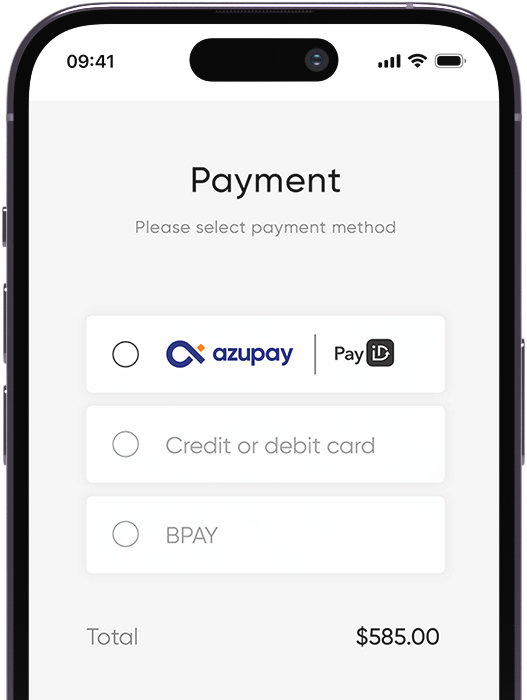

PayID simplifies the payment process by removing the need for your customers to remember credit card, BSB and account numbers.

How it Works

A faster, safer and more convenient way for your customers to pay in real-time.

Azupay’s implementation options meet a broad range of business needs.

Pricing that meets your business needs

Clear and simple pricing

With just a low, per-transaction fee, our pricing structure is simple and easy to understand.

Competitive cost model

Azupay's fee is not based on a percentage of your sale. So we keep your transaction costs well below the average Merchant Service Fee (MSF).

Avoid the surcharge

With Azupay's low transaction cost, you’ll have the flexibility to avoid surcharging or to offer a discount to your customers.

Real-time settlement

Leveraging the New Payment Platform, Azupay's real-time settlement capability means you’ll receive your funds instantly, improving your cash flow and providing greater payment flexibility for your debtors.

Start your real-time payments journey today.

Our team is dedicated to providing prompt and helpful responses to all inquiries. We look forward to hearing from you.