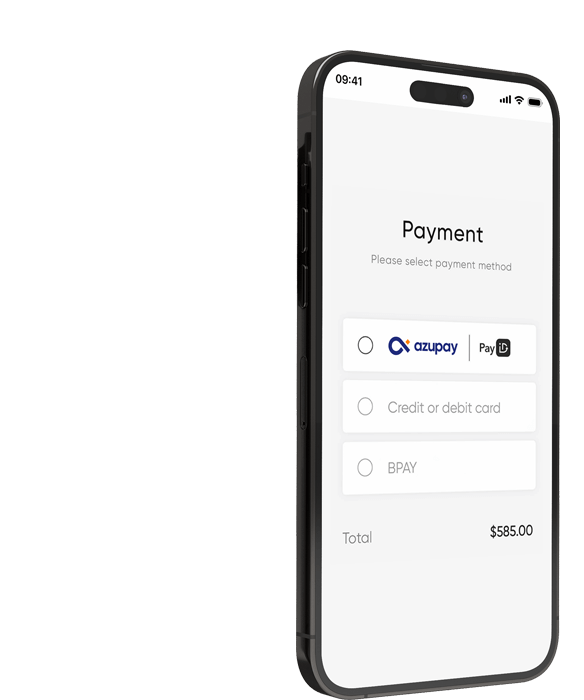

Azupay removes the frustration of legacy payment platforms by connecting businesses to faster, safer and smarter payment experiences with PayID and PayTo.

Powering business payments with:

PayID for business

Enable fast, secure, and low-cost payments for you and your customers with PayID.

Accept real-time customer bank payments 24/7 365. Speed up cashflow and reconciliation and save on transaction fees with Australia’s first NPP-powered payment solution for business. PayID simplifies the payments receivables process by removing the need for your customers to remember and manually enter card or account numbers.

PayOut

Real-time outbound payments to customers, suppliers or employees.

Ensure outbound payments land in minutes, instead of days. Take control of your cash management, with real-time payment capabilities leveraging our always on APIs that allow you to process payroll 24/7 365. PayOut also lets you handle time-critical payments, all while eliminating accounts payable errors through automated payment validation.

PayTo

The convenient new way for customers to authorise one-off and recurring payments.

The modern alternative to direct debit is here. Reduce missed payments, dishonours and provide the self-managed payment experience customers expect with PayTo. Fast track your implementation with our industry leading checkout experience, shaped by extensive business and payer research.

Solving the biggest challenges in payments for billers, banks, business and government

Admin

Time

Cost

Fraud

Transition your payments experience to real-time payments powered by the New Payments Platform.

Payments can be error prone and inefficient. Reconciliation processes are costly and time consuming.

The value of card-not-present crime rose 7.8% to $478 million in 2019 and accounts for 85% of all credit card fraud. Globally, merchants lose around 7.5% of revenue to chargebacks.

Settlement times are too long. Your business can’t receive payment on weekends or public holidays.

Credit card fees take a percentage of your revenue and interchange fees still remain, increasing the overall cost to your business. In 2018, Australian credit card fees totaled $1.5 billion.

Start your real-time payments journey today.

Speak with one of our solutions experts to learn how Azupay’s suite of real-time payment solutions can benefit your business and guide your through the implementation process.